Jessica Cejnar Andrews / Friday, May 24, 2024 @ 4:42 p.m.

Housing Developments Will Bring Major Increase In One-time Revenue, Crescent City Manager Eric Wier Says

Sam Schauerman's 56-unit Roosevelt Estates is one of several housing developments being planned within Crescent City limits. | File Photo: Jessica C. Andrews

With more than 300 housing units coming online in the next fiscal year, Crescent City is expected to see an increase in one-time funding, along with a potential 10 percent increase in population.

The additional money will be the result of developers paying for building permits, planning fees and other city services, City Manager Eric Wier told councilors Tuesday. But it will be offset by one-time expenditures, including the need for consultants to help the city’s building inspector.

But, Wier said, he and Finance Director Linda Leaver and other city staff anticipate an increase in future revenues.

“We don’t know what that’s going to do in sales tax?” Wier said. “How much [are] they going to buy in materials here locally — we think quite a bit. We know there are going to be a ton of laborers here in our community. They’re going to be going out to eat, they’re going to be buying things. That should be a shot in the arm for the next few years, but again we don’t know.”

The Crescent City Council held two budget workshops this week, about a month after Arcata-based DANCO Group broke ground on Harbor Point Apartments — a 27-unit senior housing project slated for 665 H Street.

Synergy Community Development Corporation is developing Battery Point Apartments at Gary and E streets. Wier told councilors on Tuesday that even though the developers haven’t broke ground yet, the 40-unit senior apartment building will probably be available for occupants in January or February. Battery Point Apartments also includes 122 units for low-income renters.

Then there’s Sam Schauerman’s Roosevelt Estates, which will offer 56 moderate-income units at 1405 California Street.

At Tuesday’s workshop, councilors learned that projected revenues included about $2.3 million each in sales tax and Measure S tax revenue. Revenue from transient occupancy tax was coming in at just under $2 million.

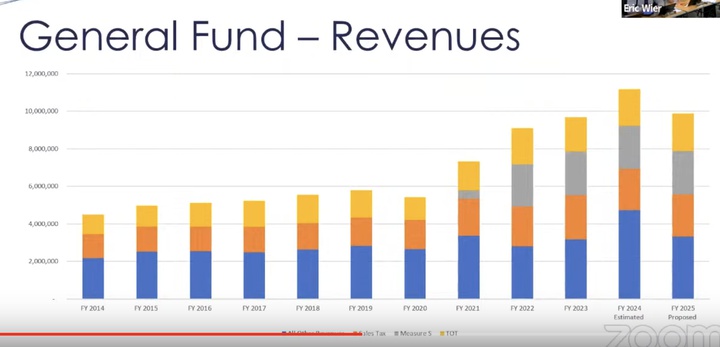

However, the overall projected revenue for fiscal year 2024-25 is $9.9 million, Leaver said, “mostly related to that housing development.” Leaver showed a bar graph depicting the city’s major revenue sources, including “everything not sales tax, Measure S and TOT.”

That “everything not sales tax, Measure S and TOT” was expected to increase in fiscal year 2024 and then immediately decrease the year after, Leaver said.

“That’s mostly related to that housing development,” she said. “We had significant fee revenue for plan checks [and] building permit fees for all of that development. That’s a big bump in our revenues this year, which is going to go into the ending general fund balance for this current fiscal year, making it look higher.”

According to Leaver’s presentation, Crescent City received $500,000 in building permit fees during the 2023-24 fiscal year. The city typically gets $70,000 annually in building permit fees.

Crescent City also received $285,000 in planning fees for the current fiscal year, a significant increase over the $20,000 the city typically sees annually, according to Leaver’s presentation.

Crescent City also received a total of about $320,000 in grant revenue for the fiscal year 2023-24, according to Leaver’s presentation.

As for expenses, Leaver projected a total of $11.4 million with wages and benefits accounting for about half.

When she looked at expenses by department, she said the Crescent City Police Department and Crescent Fire & Rescue account for about half at a combined total of $5.8 million.

However, she pointed out that the cost to the city for the fire department is smaller, about $1.3 million, since it’s jointly funded through the Crescent Fire Protection District.

Other major expenditures include about $1.5 million for street projects, $951,913 for the swimming pool and then about $1 million for community development, which includes building inspection, code enforcement and planning, according to Leaver.

Wier noted that one of the expenditures that are connected with the housing development in the city is $295,000 for a full-time building inspector.

“This is based on a high estimate of somebody having to come from outside — because there’s not really anyone local,” he said. “We would have to pay, not only their wages, which are high, but also their living expenses.”

Wier said the $295,000 was based on an estimate Crescent City received from the consulting company it uses to review building plans.

There was some discussion about using state Community Permanent Local Housing Allocation dollars that DANCO received to help fund that expense, Wier said. The DANCO project received about $250,000 in CPLHA dollars for administrative costs, Wier said.

“In running some of these numbers, it could be about $50,000 of this could be attributed to that project and paid for by those funds,” he told councilors, adding that those dollars are in the general fund. “We can vet that number a little bit more, but as we come back, there’s $50,000 that could go just to that project.”

In response to Councilor Kelly Schellong, who did a double-take at $295,000 for one person for one year, Wier acknowledged that the expense was high.

“But we don’t want to undershoot it,” he said. “We need somebody that knows what they’re doing, that could be committed to this project because they’re going to go fast.”

Crescent City Finance Director Linda Leaver showed a bar graph with Crescent City's major revenue sources. | Screenshot

Leaver also gave a breakdown of revenue and expenditures specifically related to Measure S — the 1 percent sales tax voters approved in 2020 for public safety, streets and the swimming pool. As of the June 30, 2023 audit, the Measure S fund had a balance of $1.1 million.

Leaver estimated that at as of June 30, 2024, the Measure S fund would have an ending fund balance of $764,243. At the end of fiscal year 2025, Leaver projected an ending fund balance of $452,679.

Measure S expenditures include about $818,991 for Crescent City Fire & Rescue; $513,250 for the Crescent City Police Department; $895,000 for street repairs; and $375,000 for the Fred Endert Municipal Swimming Pool.

She noted that in addition to sharing costs with the Fire Protection District for three fire captains, volunteer stipends, recruitment and retention and upgrades to turnouts, Crescent City transfers $98,000 in Measure S dollars to an apparatus replacement fund, which will eventually replace Engine 10.

Crescent City has also allocated $90,000 in Measure S dollars for a quick response vehicle, $90,000 for the chief’s command vehicle. Leaver said the city is pursuing a U.S. Department of Agricultural Grant to pay for half of those expenses.

Crescent City is also pursuing a FEMA grant to purchase self-contained breathing apparatuses. The Measure S Oversight Committee chose not to spend $100,000 annually set aside for SCBAs this year, which means it will have $200,000 next year. Combined with another $200,000 from Crescent Fire Protection District, Leaver said the city aims to do a bulk purchase for SCBAs next year.

Measure S expenditures for Crescent City police next year will include three patrol officers. Measure S already pays for a detective, body cameras, Tasers and dash cameras and for two K9 officers. There’s also a Measure S fund for vehicle replacements and a $90,000 debt service payment to the USDA for improvements to the police station.

Giving a bird’s-eye view, Leaver noted that estimated revenues for fiscal year 2023-24 is about $11.2 million, an increase from the $10.6 million initially budgeted for in 2023-24. The estimated fiscal year 2023-24 ending fund balance is $4.6 million, higher than the $3.2 million initially budgeted for.

Noting the proposed $9.9 million in revenues for fiscal year 2024-25 and taking into account the proposed $11.4 million in expenses, Leaver said she’s projecting an ending fund balance of about $3.1 million. She also added an additional 5 percent “budget-to-actual assumption,” which put the city’s projected 2024-25 ending fund balance at nearly $3.6 million.

Noting that the City Council has a policy of maintaining a 25 percent general fund reserve, Leaver said with the 5 percent budget-to-actual variance, the city is above that reserve limit.

The Crescent City Council will discuss the fiscal year 2024-25 budget at its June 3 meeting. It will hold a public hearing June 17 before adopting the final budget, according to Wier.

CLICK TO MANAGE